ETH Price Prediction: Analyzing the Path to $5,000 Amid Strengthening Fundamentals

#ETH

- Technical Strength: ETH trading above key moving averages with bullish Bollinger Band positioning supports continued upward momentum

- Supply Dynamics: Significant daily exchange outflows (56,000 ETH) creating supply squeeze conditions favorable for price appreciation

- Institutional Adoption: Growing institutional interest evidenced by Fidelity's $200M+ AUM fund and WisdomTree's tokenized fund launch on Ethereum

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

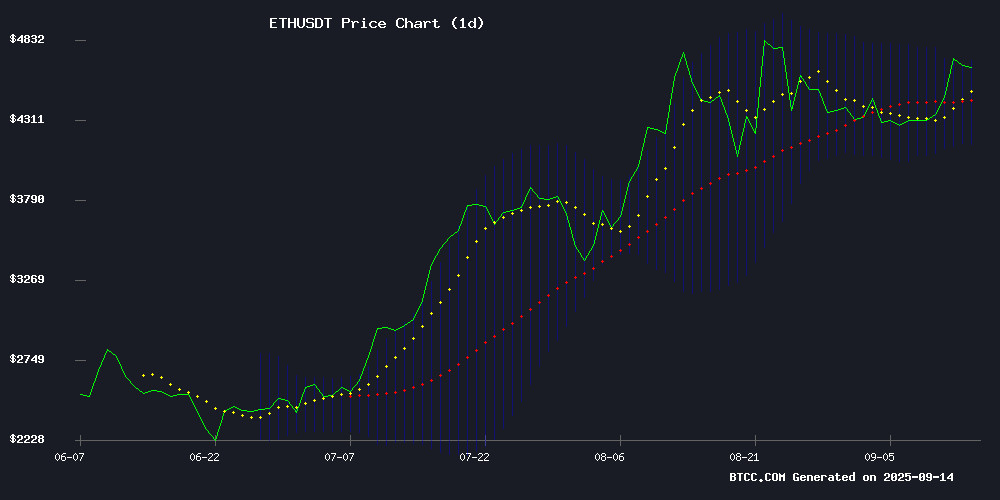

ETH is currently trading at $4,634.23, positioned comfortably above its 20-day moving average of $4,422.88, indicating sustained bullish momentum. The MACD reading of -40.61 suggests some near-term consolidation, though the price remains within the upper Bollinger Band range of $4,691.70, demonstrating strength in the current uptrend.

According to BTCC financial analyst Emma, 'The technical setup supports continued upward movement, with the $4,600 level acting as crucial support. A break above the upper Bollinger Band could signal accelerated momentum toward higher targets.'

Market Sentiment: Strong Fundamentals Support ETH's Ascent

Positive market developments are creating a favorable environment for Ethereum's price appreciation. Significant exchange outflows of 56,000 ETH daily indicate reduced selling pressure, while Fidelity's Ethereum-backed fund surpassing $200M AUM demonstrates institutional confidence.

BTCC financial analyst Emma notes, 'The combination of supply squeeze dynamics and growing institutional adoption creates a compelling bullish narrative. The $14M short liquidations further indicate strong buying pressure that could propel ETH toward the $5,000 psychological level.'

Factors Influencing ETH's Price

Ethereum Price Prediction: Bulls Eye $5,000 as Supply Squeeze Intensifies

Ethereum consolidates NEAR $4,640 after a 13% fortnightly surge, with analysts eyeing the $5,000 threshold. Exchange reserves plummet to 18.8M ETH—the lowest since 2016—while staking locks 30% of supply. Whale accumulation signals institutional conviction in ETH's structural scarcity.

The sell-side liquidity crunch accelerates as exchange outflows hit record pace. Technical charts suggest bullish momentum, with $4,070 now established as a firm support floor. Market capitalization holds at $559.9B amid $27.9B daily volume.

Ethereum Outflow Signals Strength as 56,000 ETH Daily Withdrawn From Exchanges

Ethereum's market resilience is underscored by a sustained negative netflow across exchanges, with approximately 56,000 ETH withdrawn daily over the past 30 days. This trend, reminiscent of the depths of the last bear market, reflects a decisive shift in investor sentiment from fear to long-term accumulation.

On-chain analyst Darkfost highlights the consistency of outflows since Ethereum's drop from $4,000 to $1,500, noting occasional spikes exceeding 400,000 ETH withdrawals. The absence of positive netflows suggests growing conviction among holders, positioning ETH for potential supply-driven appreciation.

Ethereum Foundation Shifts Focus to Privacy Protections in New Roadmap

The ethereum Foundation has unveiled a new roadmap prioritizing default privacy protections, marking a strategic pivot from experimental projects to scalable solutions. Published on September 12 by the rebranded Privacy Stewards of Ethereum (PSE), the plan frames privacy as foundational for blockchain's role in commerce, governance, and identity.

PSE's mission aligns with Vitalik Buterin's longstanding advocacy for privacy as a basic right. The co-founder has previously argued for private transactions to become the network default, enabling users to interact with applications without exposing their activity. The group now commits to embedding privacy across Ethereum's protocol, infrastructure, and applications—aiming for seamless, cost-effective solutions that meet global compliance standards.

Three pillars structure the initiative: private writes, undisclosed in this excerpt, will likely address transactional anonymity. PSE emphasizes collaboration with protocol teams to implement necessary LAYER 1 changes, ensuring censorship-resistant privacy without intermediaries.

WisdomTree Launches Tokenized Private Credit Fund on Ethereum and Stellar

WisdomTree (NYSE: WT) has introduced the Private Credit and Alternative Income Digital Fund, tokenized as CRDT and trading under the ticker CRDYX. The fund offers retail and institutional investors exposure to private credit markets through Ethereum and Stellar blockchains.

Designed to track the Gapstow Private Credit and Alternative Income Index (GLACI), the fund mirrors WisdomTree's existing ETF strategy (HYIN). This MOVE signals growing institutional adoption of blockchain-based financial products.

Kame Aggregator Recovers 185 ETH Following Sei Exploit

Kame, a decentralized aggregator, has successfully recovered 185 ETH after a security exploit on the SEI network. The platform initially alerted users via X (formerly Twitter), urging immediate revocation of token approvals as a precautionary measure. "We sincerely apologize for the inconvenience," the team stated, emphasizing ongoing collaboration to resolve the issue.

Follow-up advisories identified two vulnerable contracts, with Kame providing step-by-step revocation instructions. "This step is critical to ensure the safety of your assets," the team reiterated. Behind the scenes, developers placed bounties to track the exploiter and engaged in Blockscan-mediated negotiations, resulting in partial fund recovery.

Fidelity's Ethereum-Backed Money Market Fund Surpasses $200M AUM

Fidelity has crossed a significant milestone with its Ethereum-based tokenized money market fund, exceeding $200 million in assets under management. The fund's growth reflects mounting institutional confidence in crypto-backed financial products.

Data from Token Terminal shows the fund reached the $200M threshold by September 1st and has maintained stability above that level. This positions Fidelity—already managing $6.4 trillion in traditional assets—as a pioneer in institutional-grade blockchain solutions.

The achievement underscores Ethereum's viability for compliant financial instruments. Fidelity's embrace of tokenization signals broader acceptance of blockchain infrastructure by traditional finance giants.

Ethereum Bulls Charge as $14M Shorts Liquidated – $5,000 Target in Focus

Ethereum's rally above $4,700 gains momentum as network valuation and open interest metrics signal further upside potential. The cryptocurrency's 30-day NVT ratio has plunged to historic lows, indicating unprecedented network activity relative to market cap—a divergence that historically precedes strong rebounds.

Open interest surged 4.11% to $32.27 billion, reflecting growing speculative appetite. This bullish positioning comes at a cost: $14 million in short liquidations underscore the market's violent upward trajectory. Key leverage clusters near $4,700 now serve as both launchpad and liquidation risk zone.

The critical question remains whether current transaction volumes reflect sustainable adoption or speculative churn. Market structure suggests traders are betting heavily on the $5,000 psychological barrier—but the path forward may prove volatile as Leveraged positions accumulate.

Ethereum Price Prediction — $7K ETH Still Possible as Stablecoin Inflows Hit $1B Daily

Ethereum's bullish trajectory remains intact, with analysts pointing to a potential surge toward $7,000 as stablecoin inflows exceed $1 billion daily. Institutional ETF flows and whale accumulation are converging to create a liquidity flood, signaling a possible breakout. Retail investors are increasingly rotating into high-upside altcoins, with Ethereum leading the charge in this early bull cycle.

September 2025 price forecasts suggest a short-term range for ETH, but broader models indicate a path to $7,000 if current momentum holds. Institutional reports highlight even more aggressive targets under favorable macro conditions, including U.S. rate cuts and sustained ETF inflows. Whale activity further bolsters the outlook, with large holders accumulating ETH and staking yields of roughly 5% incentivizing long-term holdings.

Technical analysts identify a critical breakout zone for Ethereum, drawing parallels to previous bullish cycles. A sustained move above this range could confirm the $7,000 target, as capital flows mirror patterns seen before major rallies.

Will ETH Price Hit 5000?

Based on current technical indicators and market fundamentals, ETH has a strong probability of reaching $5,000. The combination of technical strength above key moving averages, significant exchange outflows reducing available supply, and substantial institutional inflows creates a favorable environment for price appreciation.

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $4,634.23 vs $4,422.88 | Price above MA (+4.8%) |

| Bollinger Position | Near upper band ($4,691.70) | Strong momentum |

| Daily ETH Outflows | 56,000 ETH | Supply reduction |

| Institutional AUM | $200M+ | Growing adoption |

The $5,000 target represents approximately an 8% increase from current levels, which appears achievable given the current momentum and fundamental support.